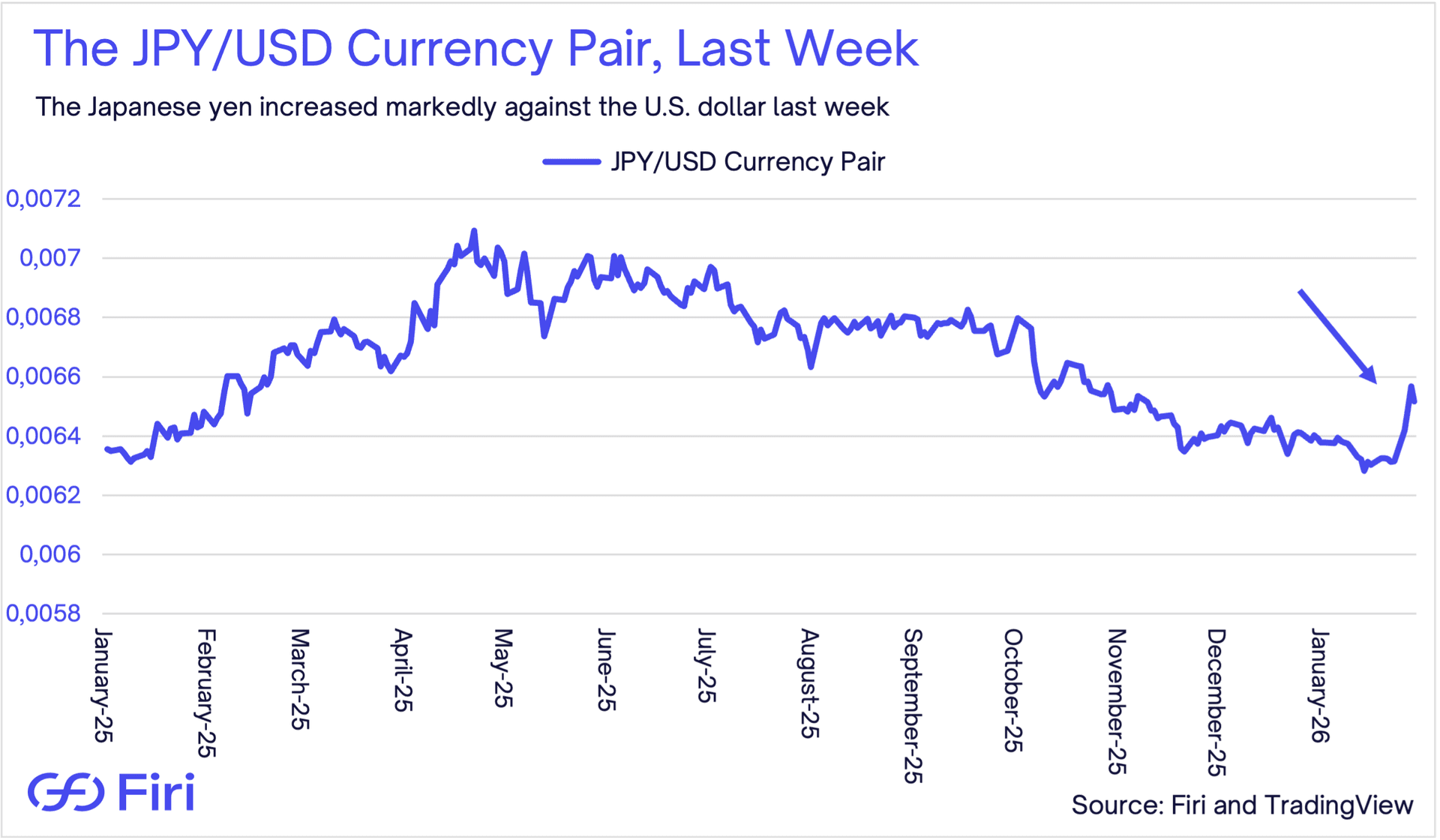

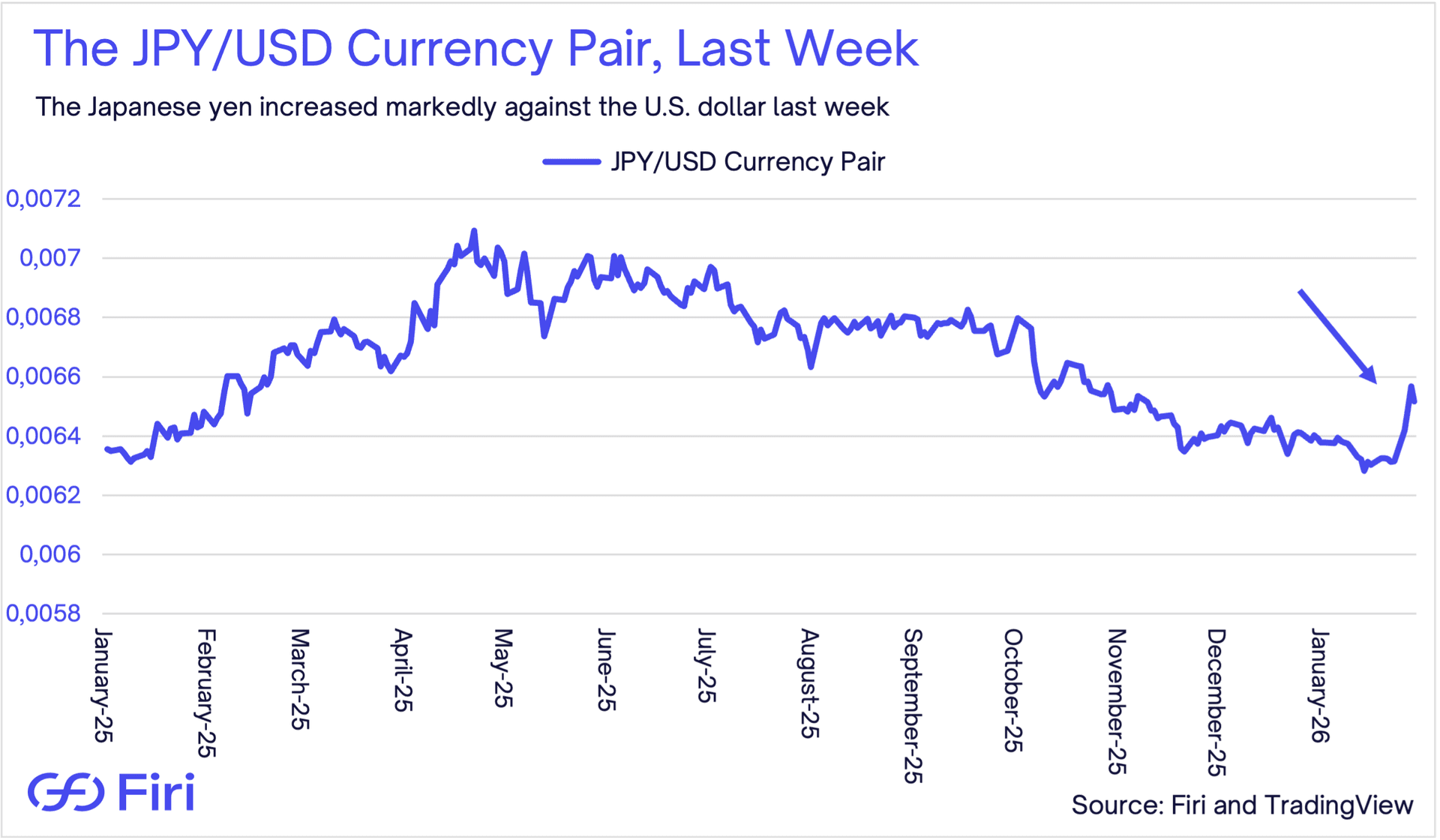

Chart 1: The JPY/USD Currency Pair

On Friday, the Japanese yen strengthened against the U.S. dollar as speculation built around possible Japanese intervention to support the currency. Some market chatter also floated potential U.S. involvement, though that part remains more speculation than confirmation.

By Sunday, crypto had sold off aggressively in a short span, with Bitcoin dropping to about $86,200 and Ethereum to roughly $2,800 before bouncing modestly—likely driven mainly by this news, and possibly by the prospect of a U.S. government shutdown.

The mechanism in play is the so-called yen carry trade. In simple terms, investors have often borrowed Japanese yen—a low-yielding funding currency—to finance exposure to higher-risk assets, including crypto. When the yen appreciates, that funding becomes more expensive to repay. The result can be a mechanical rush to reduce risk, sell liquid positions, and pay down leverage. If prices are already moving lower, the feedback loop can intensify via margin calls and liquidations.

Importantly, neither Japan nor the U.S. has confirmed intervention. Still, the overhang matters. As long as the market perceives meaningful odds of action to support the yen, the carry-trade unwind narrative will likely continue to sit in the background.

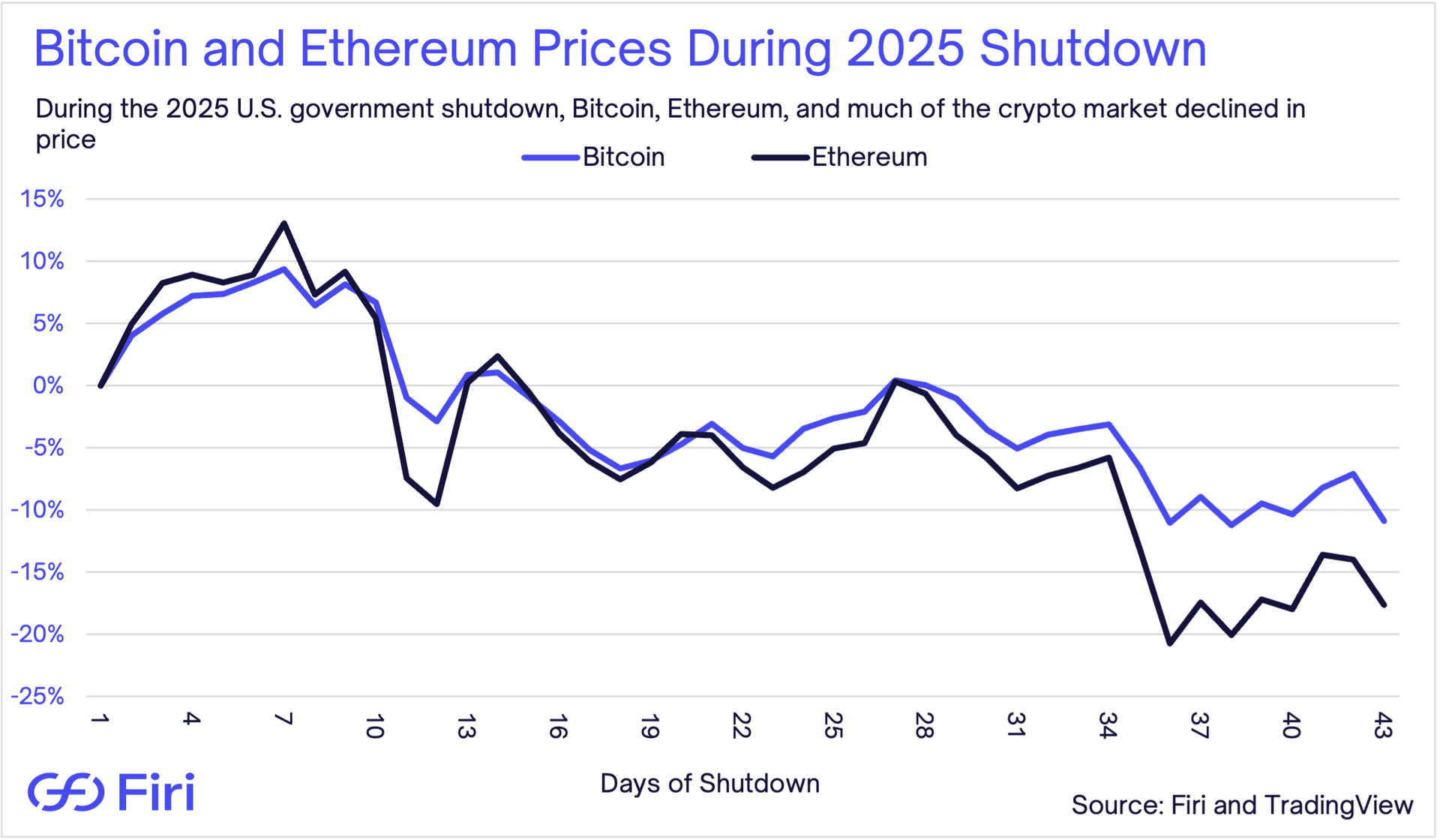

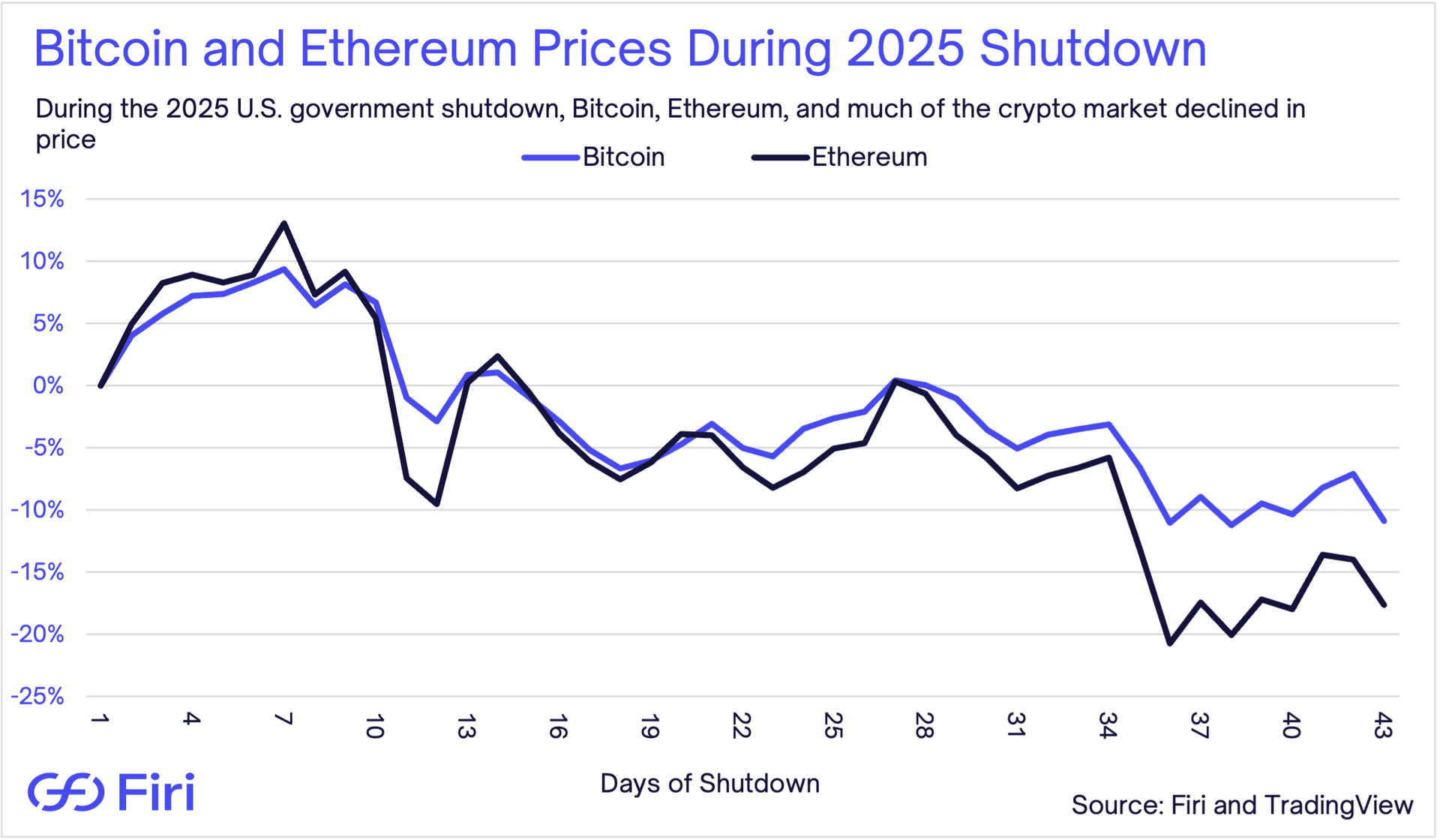

Chart 2: Bitcoin and Ethereum Price Performance During 2025 Shutdown

During the most recent U.S. shutdown period from October 1 to November 12, 2025, Bitcoin fell about 9.5% and Ethereum about 17.0%. That drawdown was clearly not merely driven by the shutdown, but also by factors such as a major liquidation event in October, extreme U.S.–China trade tensions, and broader concern about whether the rally in AI-linked equities had become overstretched.

Even so, shutdowns tend to be negative for risk-on assets, including crypto. When government operations pause, key economic data can be delayed, making it harder to price growth and inflation in real time. That uncertainty typically pushes investors toward caution. Shutdowns are also economically costly, which can weigh on sentiment more broadly. This time, when the potential shutdown is partial and narrower in scope, the impact may be less severe, but the direction of travel for risk appetite is still usually negative.